Financial management is essential for both individuals and businesses aiming for long-term stability and growth. It involves planning, organizing, directing, and controlling the financial activities of an entity, ensuring that resources are used effectively and efficiently to meet financial goals.

Key Components of Financial Management

Budgeting: Creating a comprehensive plan that outlines expected income and expenditures, helping to allocate resources appropriately.

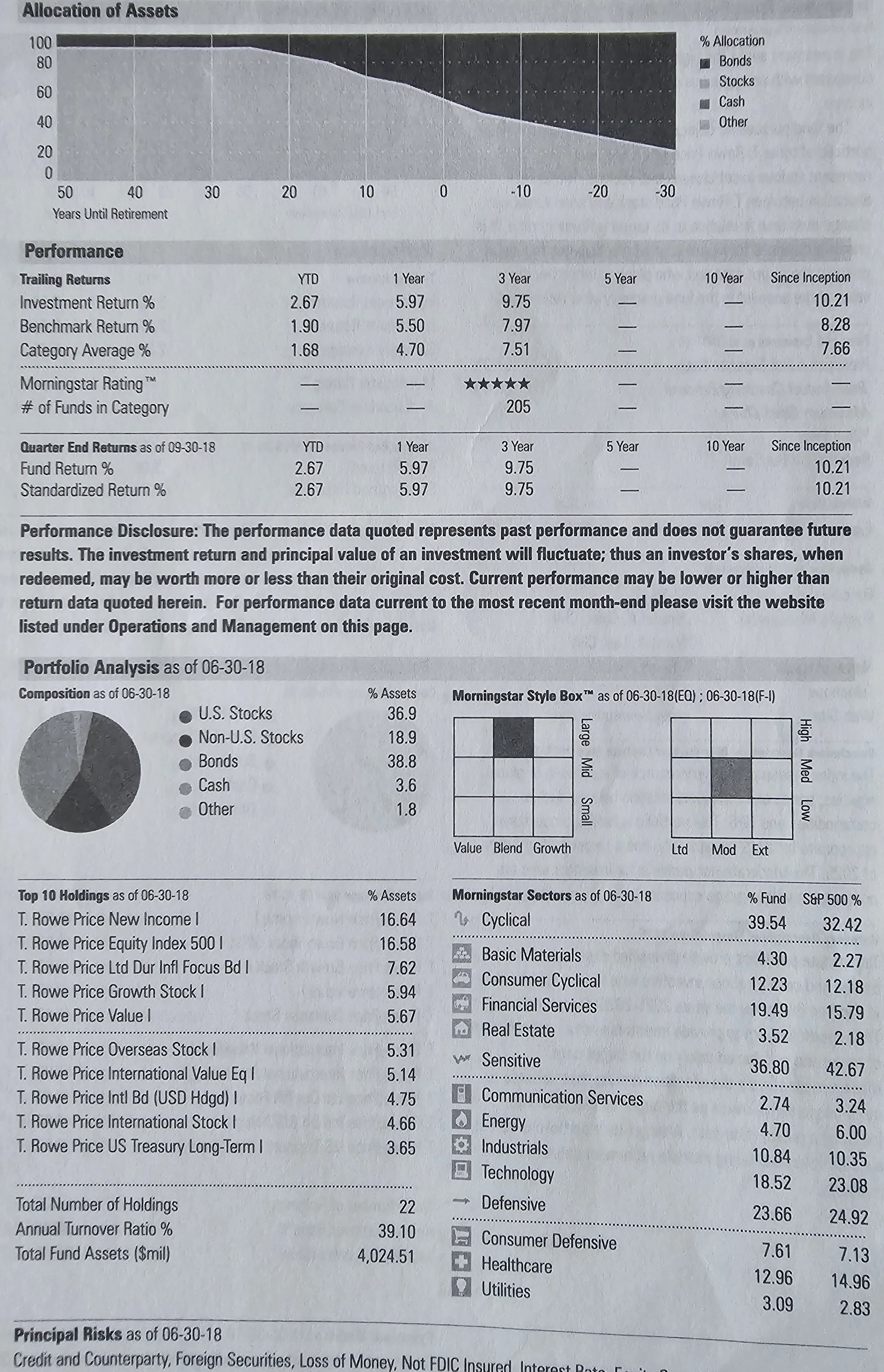

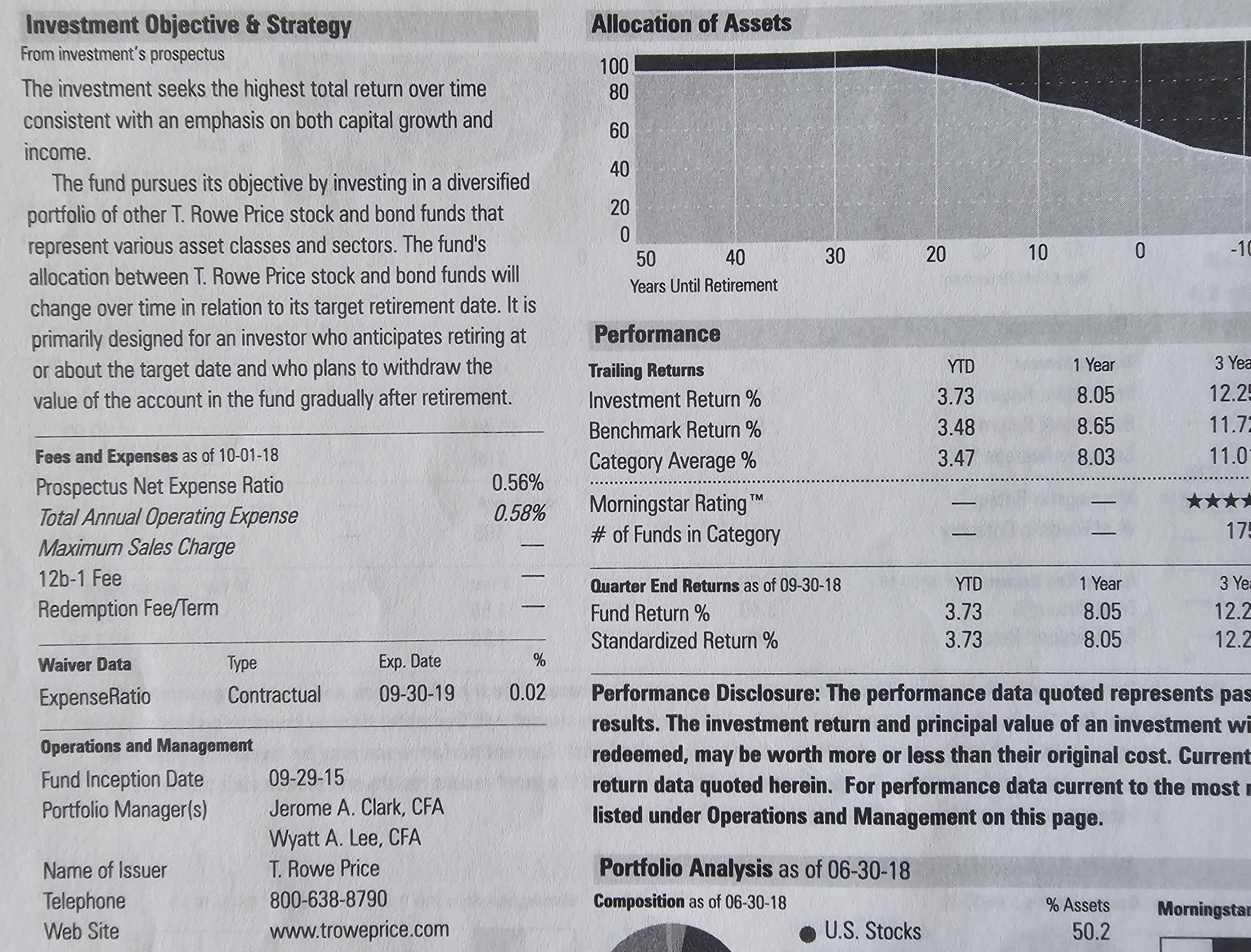

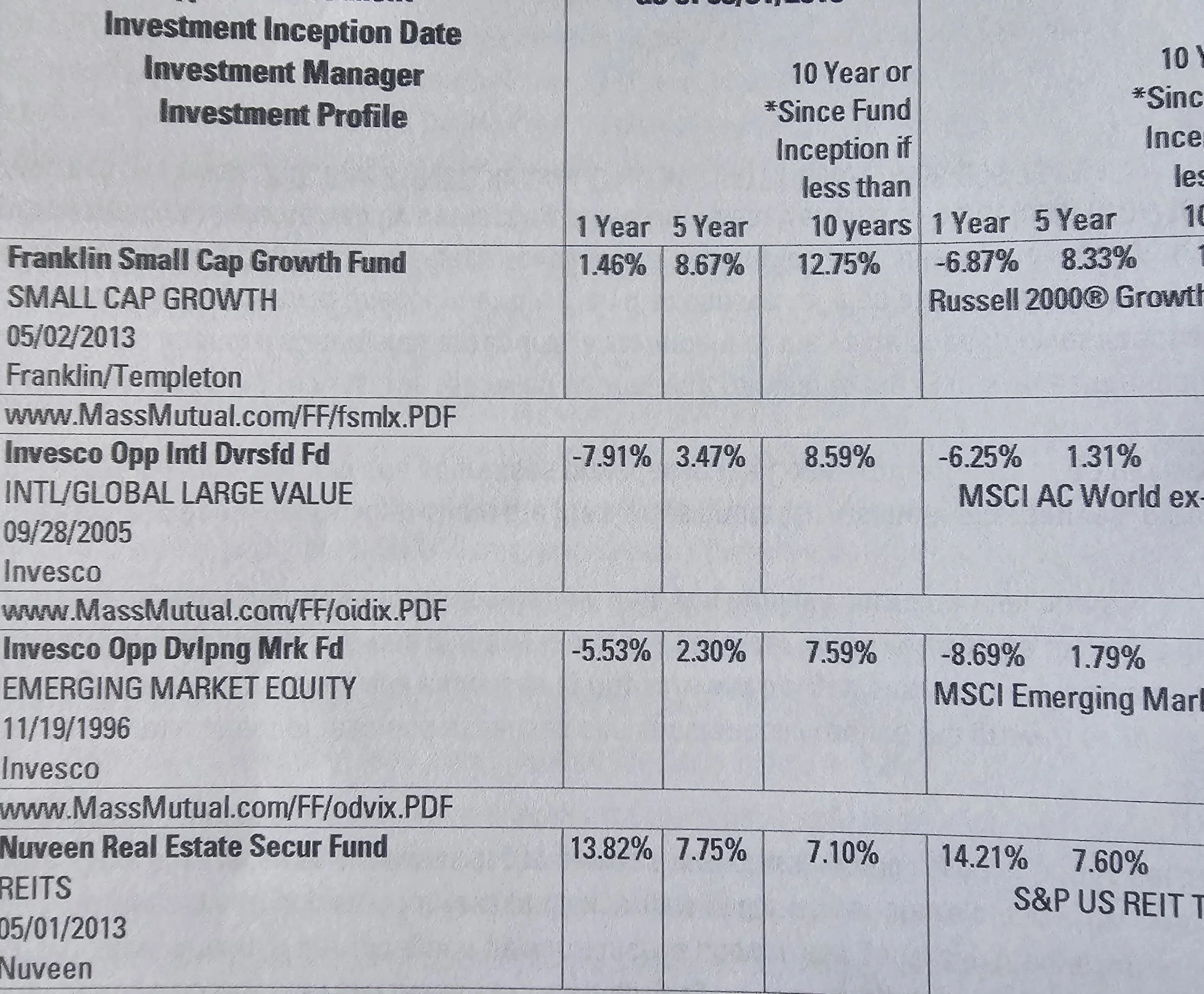

Investments: Assessing various investment opportunities, evaluating risk vs. return, and making informed decisions to grow wealth over time.

Cash Flow Management: Monitoring inflows and outflows of cash to maintain liquidity and meet obligations as they arise.

Financial Analysis: Utilizing tools like ratio analysis, trend analysis, and forecasting to assess financial health and inform strategic decisions.

Debt Management: Understanding and managing liabilities effectively to minimize cost and maintain a healthy balance sheet.

Tax Planning: Strategizing to optimize tax liabilities, ensuring compliance while maximizing after-tax income.

Importance of Financial Literacy

Enhanced financial literacy is crucial for making informed decisions, understanding financial products, and navigating the complexities of personal and business finance. Resources such as workshops, online courses, and financial advisors can aid in building this knowledge.

Conclusion

Effective financial management and literacy empower individuals and organizations to achieve their financial objectives, reduce risks, and enhance opportunities for growth. By developing a solid financial strategy our exclusve algorithms, state of the art tech and continuously adapting and educating our staff, this can help ensure long-term success in an ever-changing economic environment.

-

Our comprehensive services empower you to make well-informed decisions that can significantly lead to increased income, improved investment strategies, and the sustainable accumulation of long-term wealth.

-

Unlock your potential for financial growth with our comprehensive solutions designed to align with your personal and professional goals. In today's rapidly changing economy, the ability to adapt and thrive is crucial to building sustainable wealth.

-

With our extensive expertise in the field, you can gain access to highly tailored and specific information through advanced custom algorithms designed to meet your unique needs, enabling you to effectively achieve your goals and aspirations in a more streamlined manner.